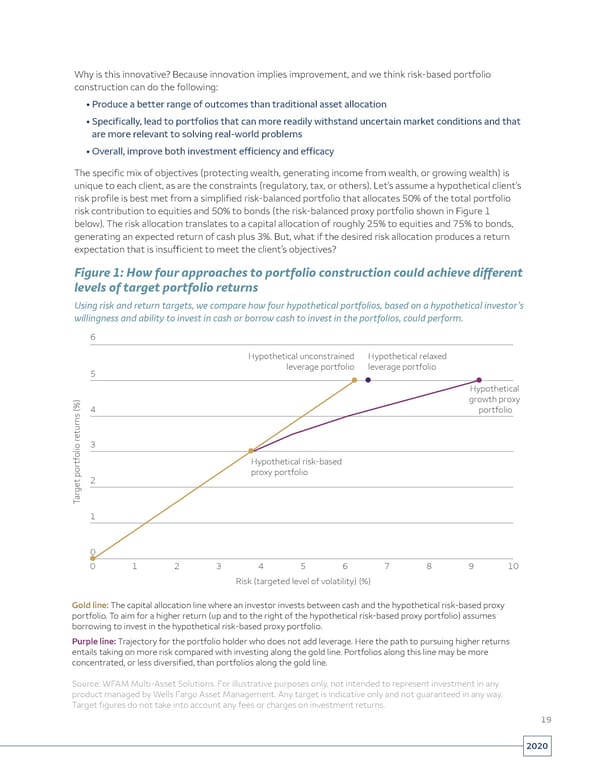

Why is this innovative? Because innovation implies improvement, and we think risk-based portfolio construction can do the following: • Produce a better range of outcomes than traditional asset allocation • Specifically, lead to portfolios that can more readily withstand uncertain market conditions and that are more relevant to solving real-world problems • Overall, improve both investment efficiency and efficacy The specific mix of objectives (protecting wealth, generating income from wealth, or growing wealth) is unique to each client, as are the constraints (regulatory, tax, or others). Let’s assume a hypothetical client’s risk profile is best met from a simplified risk-balanced portfolio that allocates 50% of the total portfolio risk contribution to equities and 50% to bonds (the risk-balanced proxy portfolio shown in Figure 1 below). The risk allocation translates to a capital allocation of roughly 25% to equities and 75% to bonds, generating an expected return of cash plus 3%. But, what if the desired risk allocation produces a return expectation that is insufficient to meet the client’s objectives? Figure 1: How four approaches to portfolio construction could achieve different levels of target portfolio returns Using risk and return targets, we compare how four hypothetical portfolios, based on a hypothetical investor’s willingness and ability to invest in cash or borrow cash to invest in the portfolios, could perform. 6 Hypothetical unconstrained Hypothetical relaxed 5 leverage portfolio leverage portfolio Hypothetical growth proxy 4 portfolio eturns (%) 3 olio r tf Hypothetical risk-based proxy portfolio 2 get por ar T 1 0 0 1 2 3 4 5 6 7 8 9 10 Risk (targeted level of volatility) (%) Gold line: The capital allocation line where an investor invests between cash and the hypothetical risk-based proxy portfolio. To aim for a higher return (up and to the right of the hypothetical risk-based proxy portfolio) assumes borrowing to invest in the hypothetical risk-based proxy portfolio. Purple line: Trajectory for the portfolio holder who does not add leverage. Here the path to pursuing higher returns entails taking on more risk compared with investing along the gold line. Portfolios along this line may be more concentrated, or less diversified, than portfolios along the gold line. Source: WFAM Multi-Asset Solutions. For illustrative purposes only, not intended to represent investment in any product managed by Wells Fargo Asset Management. Any target is indicative only and not guaranteed in any way. Target figures do not take into account any fees or charges on investment returns. 19 2020

Wells Fargo Investment Insights Page 18 Page 20

Wells Fargo Investment Insights Page 18 Page 20