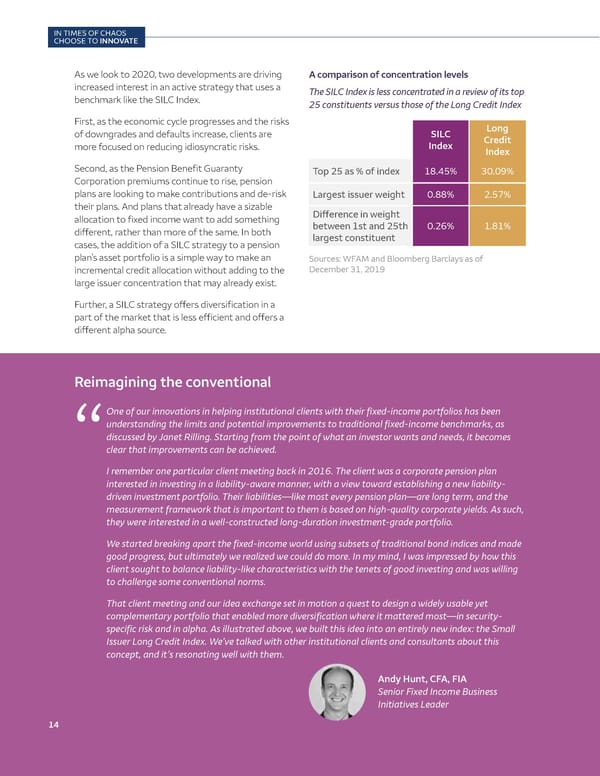

IN TIMES OF CHAOS CHOOSE TO INNOVATE As we look to 2020, two developments are driving A comparison of concentration levels increased interest in an active strategy that uses a The SILC Index is less concentrated in a review of its top benchmark like the SILC Index. 25 constituents versus those of the Long Credit Index First, as the economic cycle progresses and the risks Long of downgrades and defaults increase, clients are SILC Credit more focused on reducing idiosyncratic risks. Index Index Second, as the Pension Benefit Guaranty Top 25 as % of index 18.45% 30.09% Corporation premiums continue to rise, pension plans are looking to make contributions and de-risk Largest issuer weight 0.88% 2.57% their plans. And plans that already have a sizable Difference in weight allocation to fixed income want to add something between 1st and 25th 0.26% 1.81% different, rather than more of the same. In both cases, the addition of a SILC strategy to a pension largest constituent plan’s asset portfolio is a simple way to make an Sources: WFAM and Bloomberg Barclays as of incremental credit allocation without adding to the December 31, 2019 large issuer concentration that may already exist. Further, a SILC strategy offers diversification in a part of the market that is less efficient and offers a different alpha source. Reimagining the conventional One of our innovations in helping institutional clients with their fixed-income portfolios has been understanding the limits and potential improvements to traditional fixed-income benchmarks, as discussed by Janet Rilling. Starting from the point of what an investor wants and needs, it becomes “clear that improvements can be achieved. I remember one particular client meeting back in 2016. The client was a corporate pension plan interested in investing in a liability-aware manner, with a view toward establishing a new liability- driven investment portfolio. Their liabilities—like most every pension plan—are long term, and the measurement framework that is important to them is based on high-quality corporate yields. As such, they were interested in a well-constructed long-duration investment-grade portfolio. We started breaking apart the fixed-income world using subsets of traditional bond indices and made good progress, but ultimately we realized we could do more. In my mind, I was impressed by how this client sought to balance liability-like characteristics with the tenets of good investing and was willing to challenge some conventional norms. That client meeting and our idea exchange set in motion a quest to design a widely usable yet complementary portfolio that enabled more diversification where it mattered most—in security- specific risk and in alpha. As illustrated above, we built this idea into an entirely new index: the Small Issuer Long Credit Index. We’ve talked with other institutional clients and consultants about this concept, and it’s resonating well with them. Andy Hunt, CFA, FIA Senior Fixed Income Business Initiatives Leader 14

Wells Fargo Investment Insights Page 13 Page 15

Wells Fargo Investment Insights Page 13 Page 15