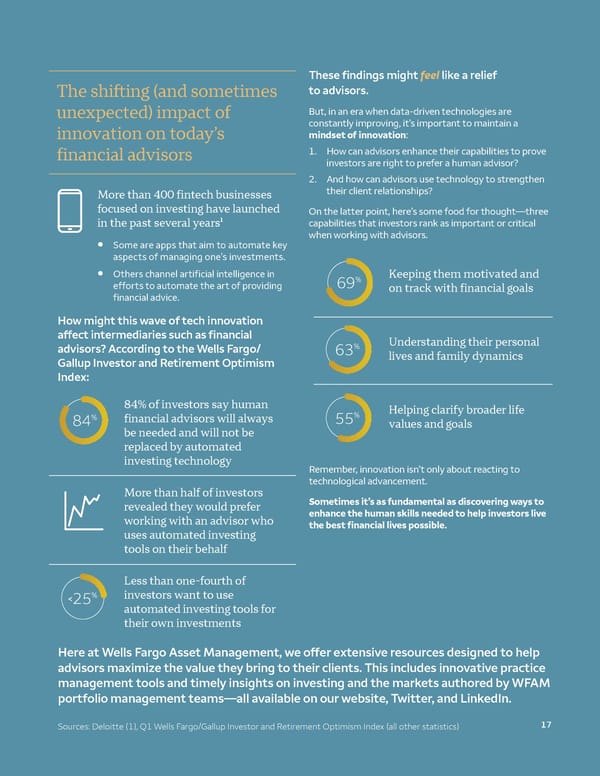

These findings might feel like a relief The shifting (and sometimes to advisors. unexpected) impact of But, in an era when data-driven technologies are constantly improving, it’s important to maintain a innovation on today’s mindset of innovation: 1. H ow can advisors enhance their capabilities to prove financial advisors investors are right to prefer a human advisor? 2. A nd how can advisors use technology to strengthen their client relationships? More than 400 fintech businesses focused on investing have launched On the latter point, here’s some food for thought—three in the past several years¹ capabilities that investors rank as important or critical l when working with advisors. Some are apps that aim to automate key aspects of managing one’s investments. l Others channel artificial intelligence in 69% Keeping them motivated and efforts to automate the art of providing on track with financial goals financial advice. How might this wave of tech innovation affect intermediaries such as financial Understanding their personal advisors? According to the Wells Fargo/ 63% Gallup Investor and Retirement Optimism lives and family dynamics Index: 84% of investors say human % % Helping clarify broader life 84 financial advisors will always 55 values and goals be needed and will not be replaced by automated investing technology Remember, innovation isn’t only about reacting to technological advancement. More than half of investors Sometimes it’s as fundamental as discovering ways to revealed they would prefer enhance the human skills needed to help investors live working with an advisor who uses automated investing the best financial lives possible. tools on their behalf Less than one-fourth of < % investors want to use 25 automated investing tools for their own investments Here at Wells Fargo Asset Management, we offer extensive resources designed to help advisors maximize the value they bring to their clients. This includes innovative practice management tools and timely insights on investing and the markets authored by WFAM portfolio management teams—all available on our website, Twitter, and LinkedIn. 17 Sources: Deloitte (1), Q1 Wells Fargo/Gallup Investor and Retirement Optimism Index (all other statistics)

Wells Fargo Investment Insights Page 16 Page 18

Wells Fargo Investment Insights Page 16 Page 18